Advantages of Using an Acumatica ERP Payment System

How to Save Time and Money by Adopting an Acumatica ERP Payment System Saving time and money with business systems integration is a common theme in...

3 min read

Jeremy Burt 12:30 PM on August 7, 2023

This blog post will discuss the advantages of integrating Acumatica credit card processing with Level 3. By doing so, businesses can reduce costs and increase their cash flow. Acumatica customers have already seen a profit boost by automating and integrating their various business processes. One area where additional profits can be gained is in automating payments. A recent study of CFOs found that payment digitization is becoming increasingly important in promoting overall financial health. In fact, 38% of participants reported accelerating their payment digitalization activities to improve their bottom line. Get the full report by payments industry news analysts at PYMTS.com: Business Payments Digitization: A Path To A Better Balance Sheet.

During the COVID-19 pandemic, there was a surge in digital payments among businesses. It's typical for commercial cards to be utilized for business-to-business payments. According to the Market Statsville Group (MSG), the global commercial cards market size is expected to grow from USD 4764.72 million in 2022 to USD 10556.75 million by 2033, at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2033. As commercial card usage increases, implementing Level 3 payment processing can help decrease the costs associated with commercial card processing.

Let’s begin with the basics. Credit cards transmit three levels of transaction information:

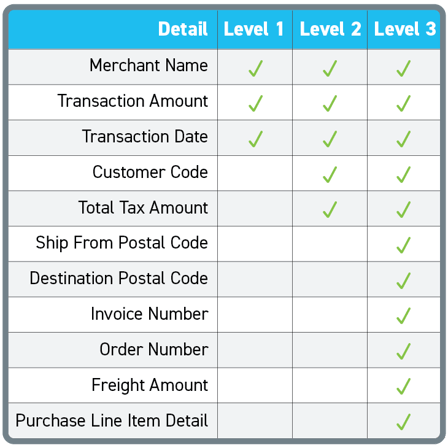

Level 1: This is the basic level. Essential information, such as the credit card number, transaction amount, merchant name, and transaction date are transmitted.

Level 2: Level 2 processing builds upon Level 1 by adding more data fields. Customer code, tax amount, and merchant postal code are included. Common use cases include transactions with government entities and corporate cards.

Level 3: Level 3 processing is the most detailed level. Line-item details, product descriptions, quantities, item codes, unit of measure, extended item amounts, and more are reported. Level 3 data is associated with corporate purchasing cards.

When you send a payment transaction, including more detailed information is known as Level 3 processing. This requires more transaction information than Level 1 and Level 2. However, the advantage is that the interchange rates for each transaction decrease as the level increases. Therefore, transaction processing costs can be reduced by collecting Level 3 data at lower interchange rates.

What is Required and How Do I Qualify?

To qualify for Level 3 (and the most favorable rates), all 11 data points that comprise enhanced data reporting must be included. See chart below for details.

It's important to note that not all credit card processors or merchant accounts support Level 3 processing. And Level 3 processing is not automatically included in all credit card transactions. It requires specific setups and capabilities from both the merchant's payment processing system and the customer's issuing bank. Finally, the availability and specific data fields required for Level 3 processing may vary depending on the payment card network (Visa, Mastercard, etc.) and regional regulations.

Acumatica’s Integrated Payments feature powered by Paya, a Nuvei, makes Level 3 processing possible and automatically happens behind the scenes.

To access Level 3 information, your consumer uses their commercial card issued by a company or government entity. The transaction details, including the amount, date, customer code, invoice number, and order number, are transmitted from your accounting system when you use integrated Acumatica payments. This allows you to qualify for the lowest Level 3 transaction rates, significantly reducing costs due to this technology.

There are many benefits to using Paya's Integrated Acumatica Payments solution beyond just the cost savings from reduced exchange rates. By utilizing this solution, you can activate payment features within Acumatica that will provide real-time cash flow information, shorten remit times, and eliminate the need for manual entry. Paya's team of payment specialists will also be available to assist you. Some of the key benefits of using Paya's Integrated Acumatica Payments include:

Paya is the leader in delivering more simple, efficient, and deeply integrated payment solutions with over 25 years of industry experience and 2,000+ industry customers and partners. Paya is certified by Acumatica and is committed to providing best-in-class integrated payment solutions for Acumatica Cloud ERP. Find Paya in the Acumatica Marketplace.

At Paya, we are unique from our competitors because we emphasize solutions engineering and engage our domain experts early in the solution process. Through a collaborative but simple hands-on process, we develop a deep understanding of our partners’ current processes, pain points and requirements to ensure you get a platform and system with the capabilities you need. As a result, Paya has enabled hundreds of businesses to optimize billing and invoice processes, deliver more payment options and flexibility to their customers, and improve back-office efficiencies.

Contact our Paya team to schedule a free consultation today!

Learn more about how our Payments experts, solutions, and processes can save you money!!

Another version of this blog was published here: Integrated Acumatica Payments Saves You Money with Level 3 Processing

How to Save Time and Money by Adopting an Acumatica ERP Payment System Saving time and money with business systems integration is a common theme in...

The #1 Question to Ask When Changing Your Acumatica Payments Gateway With so many options available for Acumatica payments and processing gateways,...

1 min read

How Can You Improve Cash Flow with Acumatica CC Payments? Shorten Your Days Sales Outstanding (DSO.) There is an accounts receivable struggle...