Sage 100 ERP Accounts Payable Video: 3 Steps to Set Up ACH Payments

Sage 100 ERP Accounts Payable Video: How to Set-Up ACH Payments and Pay Bills Electronically As Sage 100 ERP consultants that have worked with...

1 min read

Lisa Maxwell Thu, Mar 02, 2017

Anytime there's a solution that can help our clients process business transactions more efficiently and effectively, we are happy to share. Since your time is limited throughout your workday, it's great to find a solution that can help streamline the multitude of tasks that can be overwhelming with manual processes. Have you ever thought considered automating your Accounts Payables (AP) and Accounts Receivables (AR)? In this article, we will give you 5 reasons why you need to implement ACH into your system.

What does ACH mean? ACH stands for Automated Clearing House, (ACH) is a secure electronic way to process debits and credits along with vendor payments, payroll and direct deposits. ACH is the oldest and most trusted way to send funds. ACH transactions are processed in groups and may be either credits (money in) or debits (money out).

In 2015, ACH transaction volume grew to more than 24 billion electronic payments, an increase of 1.3 billion payments or 5.6 percent, over 2014 volume, according to new statistics released on April 14, 2016, by NACHA — The Electronic Payments Association®.

1) Paperless and secure - Paper invoices, paper checks, and paper records increase the chances for fraud and mistakes – wasting both time and money.

2) Cost savings - A company can spend around $2.00 a payment using the traditional paper process. Companies that are using ACH have an estimated cost-per-payment of around approximately $0.15. Think of the amount of transactions that happen in one month, six months, and a year and calculate your savings.

3) Increased security – Human error and fraud are drastically reduced when these transactions are processed electronically. Electronically processing these checks eliminate touches in the office, in the postal system, or even in the vendor’s office. Check tampering will now be a thing of the past.

4) Enhanced productivity - Traditional payment processing is a manual, labor-intensive process that consumes a great deal of an employee’s time every week. Employees will be more productive with other tasks once this is automated.

5) Improved cash management - Managing your accounts manually can leave room for error and lack of oversight. When it is all done electronically, management will have a clear picture of cash flow. Another bonus is that simple weekly or monthly reports can be delivered via email.

ACH can provide some great efficiencies and cost reductions. Not only is this feature available within your current Sage 100 system (Version 4.4 and greater)

Photo courtesy of freedigitalphotos.net by atibodyphoto

Sage 100 ERP Accounts Payable Video: How to Set-Up ACH Payments and Pay Bills Electronically As Sage 100 ERP consultants that have worked with...

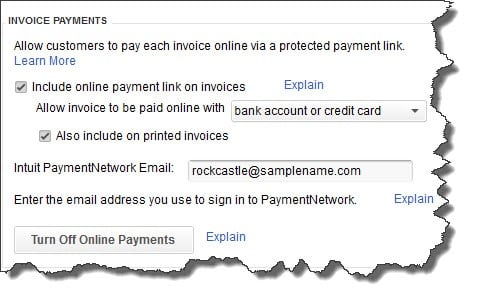

As QuickBooks consultants, we work with small business owners who want to use technology to make their business more efficient and competitive. One...

Sage 300 Customers Cut Canadian Merchant Account Fees Canada provides incentives for businesses to flock to Canada. The federal government, for...