Sage 100 ERP Connecticut Consultant: 6 Document Management Benefits

Sage 100 ERP Connecticut Consultant Reviews 6 Benefits of Implementing Document Management As Sage 100 ERP consultants, we know that document...

2 min read

Lisa Maxwell Tue, Sep 30, 2014

As Sage 100 ERP consultants in Connecticut we know the key to sales tax compliance lies in nexus. We’ve worked with many sales tax compliance for over 20 years and when it comes to tax compliance, nexus is the key to getting sales tax compliance right. So what is nexus anyway? Nexus is defined as the obligation to collect and remit tax wherever business is conducted. However, there is a range of ways nexus is created, the rules vary state by state, and many companies aren't even aware of all of the possible triggers because they're constantly changing as sales tax legislation continues to evolve. If your business collects sales tax in more than one state, defining nexus correctly is critical to getting sales tax compliance right. If your nexus is misunderstood for any reason, you expose your company to sales tax penalties and inaccuracies that lead to the risk of getting sales tax compliance wrong.

Many businesses assume they are only required to collect and file sales and use tax and manage exemption certificates in the state where their business is located. Unfortunately, that assumption usually results in hefty penalties in an audit.

To begin, almost every business has to calculate, collect, report and remit some kind of transaction tax, whether it be sales tax, seller’s use tax, exemption certificates. More than likely, you are already paying taxes in your state and local jurisdictions as a result of business location. However, what happens when you sell something across state lines? Are you required to collect sales tax and how much? And to whom do you remit the tax? Nexus rules are established by individual states and every state defines them uniquely. Determining exactly how a rule applies to a business is critical.

Making the nexus determination on your own is difficult, confusing and can lead to problems further down the road. Once you have determined where Nexus exists for your business, you are required to calculate, collect, report and remit that state’s sales tax each and every time you make a transaction.

Take the first step to end-to-end tax compliance by reading the free whitepaper, “How Sales Tax Nexus Affects Your Business” and discover where you might have unknown tax obligations. It covers nexus-creating activities such as:

Computer Management Services, LLC. is a leading provider of Sage 100 Standard, Sage 100 Premium and Sage 100 Advanced solutions in New England. Contact us at 860-399-4215 x 216 or email lmaxwell@cmsct.com and one of our certified Sage ERP consultants will be available to help you improve the quality, profitability and efficiency of your operations. Our ERP consultants are some of the most experienced and knowledgeable in the industry. Our experience spans from accounting, distribution, manufacturing, sales and marketing to warehouse automation. This gives us unique perspectives on customer service, and business solutions that allows our clients to realize and surpass their business goals.

We help you with the effective deployment of our business management solutions with Business Process Evaluation, Re-engineering, Project Planning, Project Management, Data Migration, Implementation Consulting, Forms and Screen Customization, Custom Reports etc...

Another version of this blog was previously posted on Computer Management’s Blog on August 4, 2014 by Lisa Maxwell: Nex What?!?!

Photo courtesy of www.freedigitalphotos.com

Sage 100 ERP Connecticut Consultant Reviews 6 Benefits of Implementing Document Management As Sage 100 ERP consultants, we know that document...

As a Sage 100 ERP consultant who help clients with ERP selection and implementation and ongoing supoprt, our team occasionally has clients who learn...

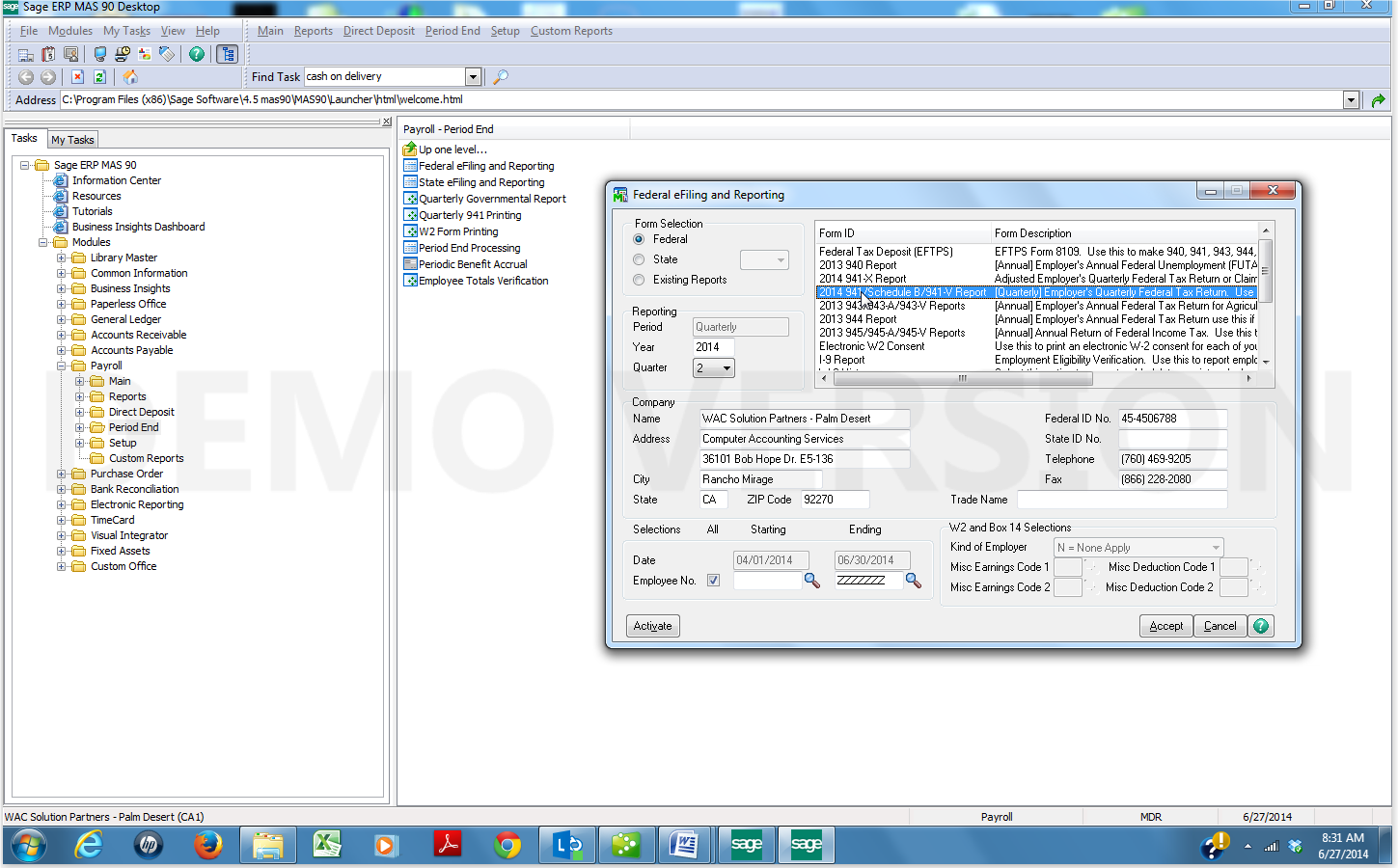

Sage 100 ERP Consultant Tip: How to Run Period End 941 - Error Free Question: We are a Sage 100 ERP User (formerly MAS90). When trying to run the...