QuickBooks Accounts Receivable Collections Made Easy

Are you having trouble managing receivable and collections on business-to-business debt?

2 min read

Adrian Montgomery Thu, Aug 16, 2012

Getting paid seems like it should be an easy thing. You provided your product or service to your customer, and gave them an invoice. You clearly stated your terms on the invoice, and now you are waiting for payment. What do you do? How many people owe you money right now? Do you know without getting into your QuickBooks and calculating? I’m going to talk about just a few of the many options you have for accounts receivable collections using QuickBooks integrated collections software. You may be able to start collecting right now.

In your QuickBooks, you have many reports. Some that are pretty and easy to follow, and some that are cumbersome and confusing. Here is a short list of reports that you can use in your QuickBooks to help with your acounts receivable collections endeavor:

A/R Aging Detail – Displays unpaid invoices and statement charges, the aging column displays how many days past due.

Collections Report- Displays overdue invoices and statement charges, but only those that are overdue.

QuickBooks launched a Collections Center in the 2012 software, I know yet another upgrade but the Collections Center can be very helpful if you have customers that need a gentle reminder. The Collections Center allows you to quickly view who is past due, or due soon. You are able to send out an email to everyone that is past due or almost due very quickly.

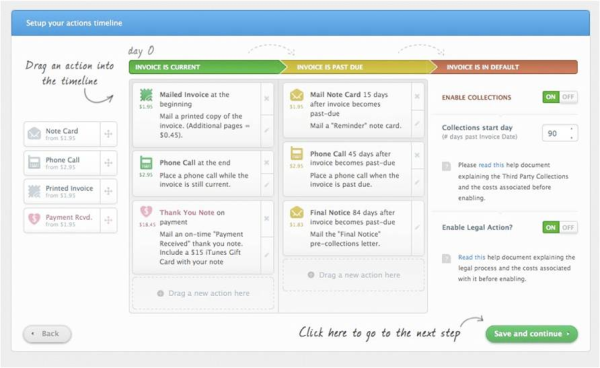

So what if you want letters to be sent in the mail, but you don’t really want to do that yourself? What if you like to email your reminders, but don’t want to spend the time sending each one out? You are in luck. There are more options for collections. If you need automation, whether it’s because you routinely send out reminders one by one, or because you just would rather not even spend the time pulling the accounts receivable collections report, then an automated solution is for you. There are two third party solutions that I know work well with QuickBooks, Anytime Collect and AR Connection. Both can be found on the intuit marketplace.

Any collections software is only going to be as good as your QuickBooks information. So be sure that all of your information is up to date. What are your terms? Do you use different terms for different customers? It is a good practice to verify information. Ideally once you enter in your information it should always stay the same, but things can happen.

Say you have a customer set-up with net 30 terms. They talk to you about a large order and ask if they can have longer to pay. Since they are such a long time customer, you agree to give them 60 days. You ask the person who is in QuickBooks at the moment to change the invoice to net 60, because you have a meeting to get to. Well, a few months down the road, you find when the little pop up asked if the customer’s term should be changed, the answer given was (however inadvertently) yes. So now, you have invoices for this customer that are overdue, but QuickBooks and your automated accounts receivable collections software think they still have time to pay.

What is the saying? An ounce of prevention is worth a pound of cure, or in this case, it may save you money or potential embarrassment. Automation is an incredibly helpful tool, if you use it wisely. If you like the idea of automating your accounts receivable collection tasks, but have questions or know that your data needs to be updated first, feel free to reach out to us for QuickBooks help at ebs Associates, we are happy to help you investigate making your collections less arduous.

Are you having trouble managing receivable and collections on business-to-business debt?

The accounts receivable collections process is like walking on a cash flow tightrope. The struggle to collect past due accounts receivable can...

When you're trying to come up with a way to get customers to respond to your collection emails and past due notices, you can try to get a little...