Sage 100 ERP: 2 Ways to Transfer Invoices to Accounts Payable

Question: Mike, we own Sage 100 ERP (formerly Sage MAS 90), how do we get invoices into Sage 100 ERP Accounts Payable and Sage 100 ERP Receipt of...

1 min read

Adrian Montgomery Wed, Sep 05, 2012

Common question: In Sage 100 ERP (formally Sage MAS90) Accounts Receivable how do I do an adjusting Invoice entry and when is it necessary?

Answer: Normally an Accounts Receivable invoice adjustment is necessary because an incorrect entry was made. Sometimes it is done when a customer requests a write-down of an invoice, but this can also be handled with a credit memo. Note when an invoice adjustment is made there is no invoice printed, so if you need something printed to give to the customer we suggest using a Credit Memo.

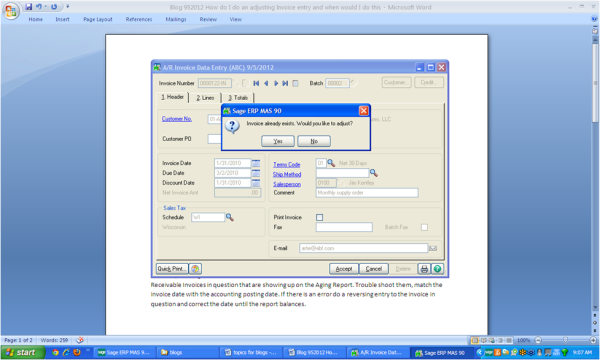

First, go to Sage 100 ERP Accounts Receivable>Main>Invoice Data Entry, type in the invoice number and customer number. After this you will see a message, Invoice already exists do you want to adjust, click the yes button.

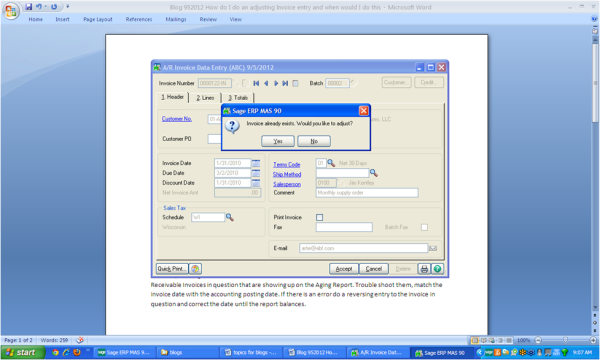

Second, the system will then pull the existing invoice information and show it on the screen, at the first screen verify the information is correct and then click the OK button.

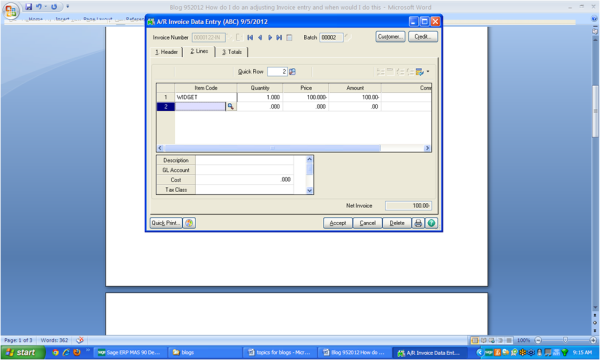

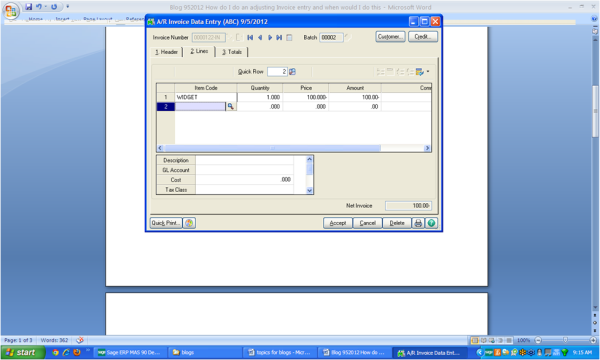

Third, the system will then pull the original invoice entry screen with the original date, click on tab #2 lines and type in the adjustment amount and use the correct item codes, you will want to make the amount negative. In our example we wanted a $100 adjustment. Accept the entry, run the Accounts Receivable sales journal and post as always.

Fourth, If the Sage 100 ERP Accounts Receivable Trail Balance Report balances, then this normally means there are dating issues with the input of Sage 100 ERP Accounts Receivable Invoice data entry. In other words an invoice with an invoice date of 5/31/2012 should be posted with an accounting date of May 2012. If it was posted with an accounting date of 6/1/2012 this would cause the Sage 100 ERP Accounts Receivable balance to not agree with the Accounts Receivable Aged Report.

Fifth and final step, through Sage 100 ERP Accounts Receivable Customer Maintenance, Invoices check each of the Accounts Receivable Invoices in question that are showing up on the Aging Report. Trouble shoot them, match the invoice date with the accounting posting date. If there is an error do a reversing entry to the Sage 100 ERP invoice in question and correct the date until the report balances.

Thank you Mike Renner at www.caserv.com for this helpful Sage 100 ERP guest blog tip! Please stay tuned for more helpful Sage 100 ERP tips!

Question: Mike, we own Sage 100 ERP (formerly Sage MAS 90), how do we get invoices into Sage 100 ERP Accounts Payable and Sage 100 ERP Receipt of...

Sage 100 ERP 2013 (formerly Sage MAS 90 and MAS 200) is a new release that brings some exciting productivity and workflow enhancements that will...

Sage 100 ERP Consultant Tip: Accounts Receivable Cash Receipts Question:Mike, we own Sage 100 ERP (formerly MAS90), when I am doing a Cash Receipt...