Question: In Sage 100 ERP (formery Sage MAS90) accounts receivable why and how do I create a credit memo?

Answer: Normally a Sage 100 ERP accounts receivable credit memo is done because of a return of some kind, such as you originally ordered 6 cases of paper, one might have been damaged so the Sage 100 ERP credit memo is sent to document the return and there is a paper trail. It can also be used for a customer account write-down. But the key is that the credit memo is much like an invoice and does show up on the accounts receivable aged invoice report.

To create a Sage 100 ERP credit memo please follow these simple steps below:

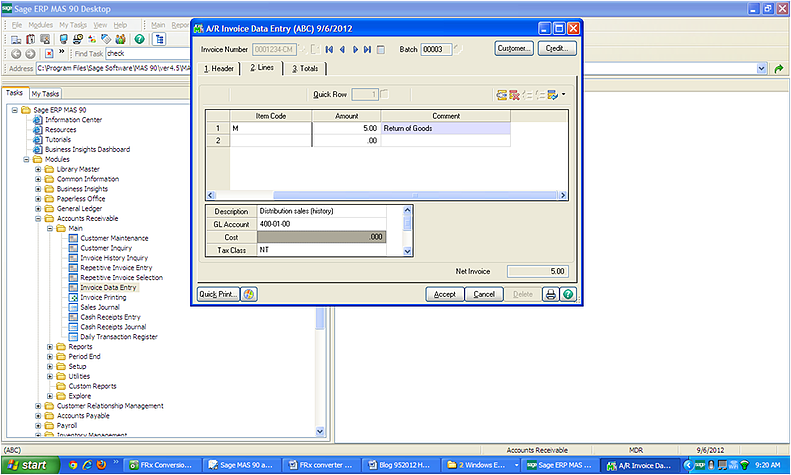

First: Go to Sage 100 ERP accounts receivable>Main>Invoice Data Entry, type in the invoice number with a CM at the end, after you enter you will note the system converts to 1234-CM instead on IN. Add the customer number and go to lines just like a normal invoice.

Second: Type in an item code, note you do not have to make the amount negative. Because you used a CM for Credit Memo the system automatically converts the lines to negative.

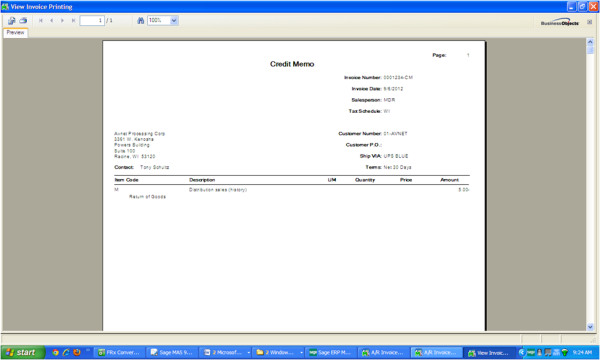

Third: Accept and print, you will note that it prints as a Credit Memo with a negative amount. Post as usual.

Mike Renner,

If you have questions please contact us at www.caserv.com, email or 760-618-1395. Please stay tuned for more helpful Sage 100 ERP tips!

Written by Mike Renner: Partner of WAC Solution Partners - Greater Los Angeles, a Sage 100 ERP support provider based in Indio, CA.

Mike is an expert on ERP and fund accounting and supports Abila Fund Accounting and Sage 100 ERP with over 25 years in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Specialties: Sage 100 ERP (formerly Sage MAS90 / MAS200), Abila MIP Fund Accounting™, Acumatica, QuickBooks Pro Advisor