Sage 100 ERP (formerly MAS 90): How to install the IRS W2 1099 End of Year IRD updates

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

1 min read

Adrian Montgomery Wed, Sep 26, 2012

Question: Mike, we own Sage 100 ERP (formerly MAS 90, MAS 200). We have closed the year and just received year-end adjustments from our CPA How do we open up the previous year and make these adjustments?

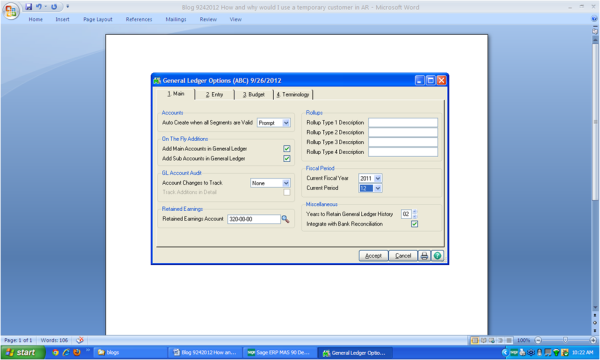

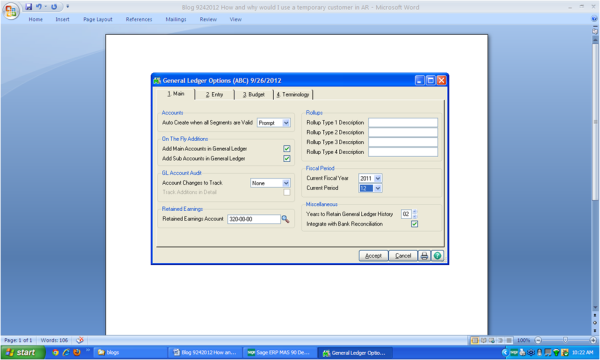

Answer: Companies that normally close periods will need to open up the previous year and make a final adjusting Journal Entry. For example, if your current period is year 2012 period 4 and you want to make the adjustment as of 12/31/2011.

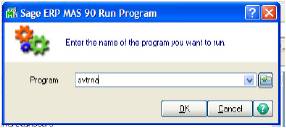

The first step is to go to Sage 100 ERP General Ledger>Setup>General Ledger Options. Write down what the current year and period are then change to year 2011 and period 12 and Accept.

Second step make the Adjusting Journal Entries as of 12/31/2011 and post them.

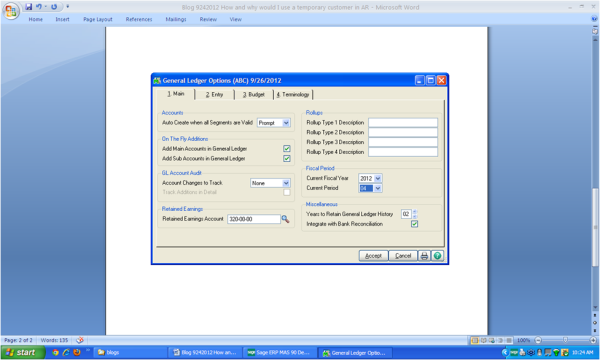

Third step, go back to Sage 100 ERP General Ledger Options and reset the period back to the original date and Accept.

Mike is an expert in Sage 100 ERP, with over 25 years of experience in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Sage 100 ERP (formerly Sage MAS90/200), Sage 100 Fund Accounting (formerly MIP Non Profit Software), Sage Grant Management, Sage Online Fundraising, QuickBooks Enterprise and Point of Sale VAR.

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90). I changed banks, and now when I print checks, it posts to the wrong GL Account. Why?

Question: Mike, we own Sage 100 ERP (formally Sage MAS90) and we are setting up a new company. We would like to copy the Sage 100 ERP Accounts...