Sage Software Consultants Review the New Sage Live Nonprofit

Sage Consultants Excited about Sage Live Nonprofit One deep commitment and a source of pride with our team of ERP consultants and professionals at...

3 min read

Adrian Montgomery Tue, Oct 23, 2012

These days the first tinsel appears far sooner than the first frosts of winter. Early tell-tale glitters of shiny plastic stuff have already been spotted around the country. This tells us that businesses are preparing for the annual wallet-feast that will help to see them through the dark sales days of January and February. Christmas, for many businesses, is all about receiving, not giving. However, the old chestnut of Corporate Responsibility also comes into play. It’s the season of goodwill to all men/women/children and businesses can facilitate the speedy transfer of cash from consumer to themselves by a little giving of their own. Corporate Social Responsibility (CSR) is often seen as the domain of large firms, but many small firms can participate and, unlike many larger firms their efforts are often perceived as being more genuine.

C’mon Scrooge, dig deep

Nobody likes a Scrooge, especially at Christmas. Most large companies spend huge amounts on the PR for their CSR programmes and while their efforts are genuinely appreciated this ‘look at me’ approach doesn’t go un-noticed. While many large firms believe that being seen to be socially responsible is good and makes people think ‘oh, aren’t they lovely, let’s spend all of our money with them’ rather than ‘that’s a particularly see-through marketing ploy.’ In the case of small firms, however, CSR can be more effective. Getting on and doing the good works, rather than promoting the fact that you are doing is a particular feature peculiar to small firms; normally budgets won’t stretch to both the good works and publicity about it. This is itself means that small-scale CSR is intrinsically viewed as more genuine. In addition, small firms tend to be more personal and it’s easier for a business owner or their employees to add a truly personal touch to the CSR.

Job Creation and Helping Hands

There are two aspects to voluntary work that can offer simple ways to give a little back to your community. Offering voluntary posts in your company that provide training in new skills can be particularly useful on two fronts and is quick route to a high profile if you work in areas that are classed as deprived. With a huge rise in school leavers on the unemployment statistics, offering work experience and training opportunities helps to develop new chances for talented young people. It can also help you to find some excellent future employees as very often kids’ from ‘poor’ schools have learned to overcome a lot of obstacles in life and can have personal skills that can be developed into first rate workplace skills. In terms of CSR this can be a win/win situation for both you and the beneficiary of your good works. The second aspect to voluntary work is also good for small firms. Encouraging your employees to offer their time for local groups, schools or good causes is a valuable CSR tool. Managed effectively this can not only raise your profile, create a greater sense of job satisfaction but also forge new and valuable links in your community.

Happy and Profitable Christmases

Christmas is a good time to organise a gift collection or to donate gifts to a huge range of charities. Whether it’s for a children’s charity around the world, or kids closer to home, organizing a company wide collection, and/or extending this to the local community shows that your heart is in the right place. It’s also one of the simplest and easiest ways to become involved in CSR at this time of year and there are charities in great numbers that genuinely need, and deserve, every little extra bit of help that they can get.

Giving with Benefits

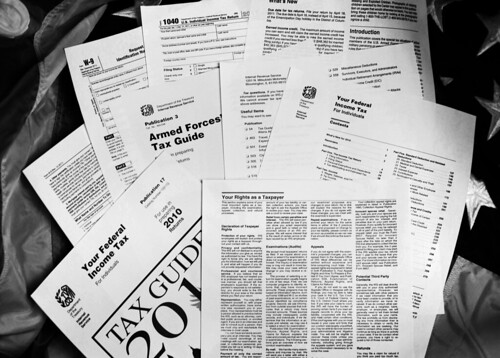

In addition to the obvious warm glow of free publicity that charity work and CSR entails, there may also be some additional tax advantages for your firm. In most circumstances charitable giving can be offset against tax and it may be possible to class a number of activities in terms of charitable donations. Check with your accountant the rules and also establish if there are gift aid benefits to any donations that you make – which will further help the charities of your choice.

Author

Carlo Pandian is a freelance writer and blogs on QuickBooks Online, PR and productivity tools. When he’s not online or cycling around, he likes reading art magazines and visiting galleries with his friends.

Sage Consultants Excited about Sage Live Nonprofit One deep commitment and a source of pride with our team of ERP consultants and professionals at...

3 min read

There are many sources of information for employers about filing W-2’s. However, it’s not always easy finding a W-2 filing checklist or summary of...

Accounting software is an extremely important tool for every business. For many small companies or start-ups QuickBooks is a great system. As time...