It’s getting to be that time of year, that’s right, fiscal year end. Don’t worry; this blog will not refer to any fiscal cliffs, political debacles, or riotous occasions – just recommendations on the simple tasks that may impact your year-end business processes.

First and foremost, now is the time to check and see what version of Sage 100 (MAS 90) you are rocking. This includes updates! Something what is often overlooked is the actual update you are running on your system, however this will tell you what hotfixes, tax table update, or payroll updates you have. The best, or at least easiest way to go about checking this is to log in to Sage 100 and go to Help > About.

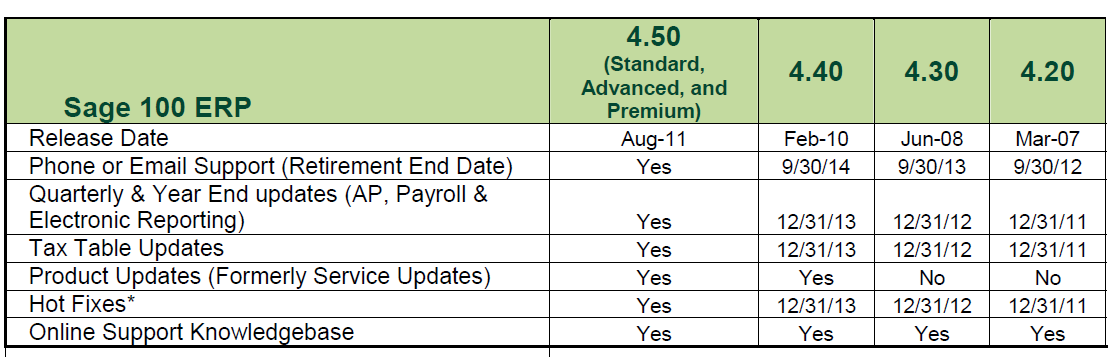

Congratulations if you are on Sage 100 version 4.50.4 – this means that you are up to date! If you are not seeing this, it might be wise to check with ASI to see if your system needs an update. Not everyone needs the most recent update, sometimes that will depend on what modules you are using. If you are not on version 4.5, then please review the chart below. There is a good chance that if you are on a version prior to 4.4 that Sage will no longer be supporting your version. What does this mean to you? Well, for those Payroll users, this is especially something to take heed of. This means that Sage will no longer be providing updates, hot fixes, tax table updates, or payroll related updates for that particular version. Also, if you call into Sage on a version that is no longer being supported, than they will no longer provide help. ASI does its best to support customers on versions 4.3 and older, but Sage will no longer provide and program fixes should a bug or system error be identified. It is no recommended that you try installing later version updates, it will not work, and no, you can’t usually make manual changes unless you are a tactfully great Sage 100 programmer. The best answer? Upgrade! This will keep you current, compliant, and a generally happy customer.

It should be noted that for 2013 Medicare Requirements, Sage will provide Medicare changes for 2013 in the January and any 941 updates in March 2013 to anyone on version 4.3. ASI and Sage want to make it simple and easy to help their customers stay compliant, and the best way to do this is through providing updates for any legal or software changes. Staying current on your software and maintenance allows you to have access to these updates!

It should be noted that for 2013 Medicare Requirements, Sage will provide Medicare changes for 2013 in the January and any 941 updates in March 2013 to anyone on version 4.3. ASI and Sage want to make it simple and easy to help their customers stay compliant, and the best way to do this is through providing updates for any legal or software changes. Staying current on your software and maintenance allows you to have access to these updates!

In other news, here are a couple other key things to note for those Payroll users out there. Sage 100 Payroll Hotfix PR4064-T was released to fix an interesting payroll issue. In Deduction Code Maintenance, when the Deduction Type is Employer Contribution and the Calculation Method is set to Percentage of Deduction, the deduction amount is calculated after reaching the standard limit. If you can’t wait to have this fixed, then install this right away! Contact ASI if you need any assistance.

Another thing to note for payroll users – do you have the most recent Tax Table Update? The 2012 Q4 Tax Table update is available! Keep in mind that it does only impact a few states, so check with ASI to see if this is something you should have installed. To see what Tax Table you have currently installed, login in to Sage 100 and go to Library Master > Reports> Run the Installed Module Listing report.

More Year End advice to come!

Jenn brings to ASI a unique background in accounting and business. With not only technical and functional experience but project management skills as well, Jenn has fundamental knowledge of all the phases of an implementation project. She has worked as an end user as well as a consultant, giving her the perspective to understand system “pain points” and know how to analyze and present solutions. Her project expertise includes: Software Implementations and upgrades, Distribution / Inventory, Client Server Applications, Business Process Reviews and Optimization, as well as System Analysis and Design. She also has experience in logistical project planning as well as technical experience with Crystal Reports and SQL. Part of Jenn’s upgrade experience also includes upgrading Sage 100 Providex clients to Sage 100 SQL. To contact Jenn or find out more about what her team at ASI can do for your business visit ASISucceed

Top 5 Reasons to Take Advantage of Product Update 6 for Sage 100 ERP

Product Update 6 has been released for all Sage 100 version 4.5 users and is now available for customers that are current on their Sage100...

Sage 100 ERP Support: Tips for the Fiscal Year End

How many of you are paying Sage software maintenance and taking advantage of what’s provided via the Sage customer portal? You’re maintenance covers...