Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process payroll. How do we get and install the new tax table updates?

Answer: Normally when the IRS issues new tax table Sage will create the new table and make it available on the Sage support website. As long as a user is current with their maintenance plan those updates are available from Sages website.

First step:

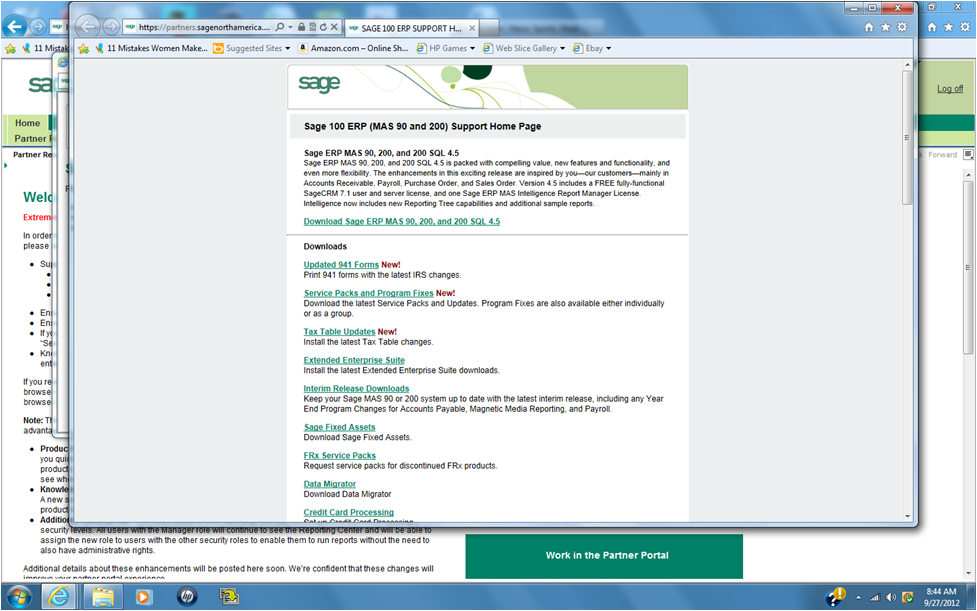

Login to the Sage support website, if you don’t know where it is contact your Sage reseller or Sage directly and they will assist you getting access.

The tax tables are available for download on the first page of the support website. You can download and save to your desktop to start with.

Second step:

Install the update:

1) Run the update install and point to the \MAS90 directory.

Third step:

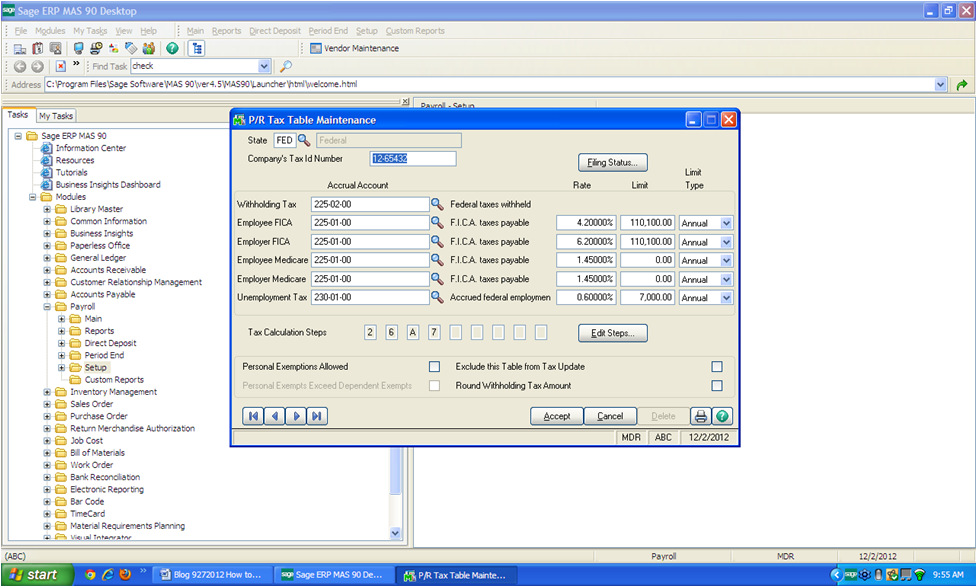

Verify that the correct tax tables got installed:

Login to Sage 100 ERP, Payroll> Setup > Tax Table Maintenance.

Set the State to be FED, and verify that tax tables agree with the IRS tax tables.

Written by Mike Renner, Partner WAC Consulting, Owner at Computer Accounting Services

Mike is and expert on Sage 100 ERPwith over 25 years in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Specialties

Sage 100 ERP (formally Sage MAS90/200), Sage 100 Fund Accounting (formally MIP Non Profit Software), Sage Grant Management, Sage Online Fundraising, QuickBooks Enterprise and Point of Sale VAR.