Sage 100 ERP (formerly MAS 90): How to install the IRS W2 1099 End of Year IRD updates

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

1 min read

Mike Renner Fri, Dec 07, 2012

Question: Mike, we own Sage 100 ERP (formally Sage MAS90), we process Payroll. How do we run the year end W2 forms.

Answer: Normally at the end of the year after the IRS issues new W2 forms, Sage will create end of year IRD and make available on the Sage support website. As long as a user is current with their maintenance plan those updates are available from Sages website. You will want to make sure this is installed first.

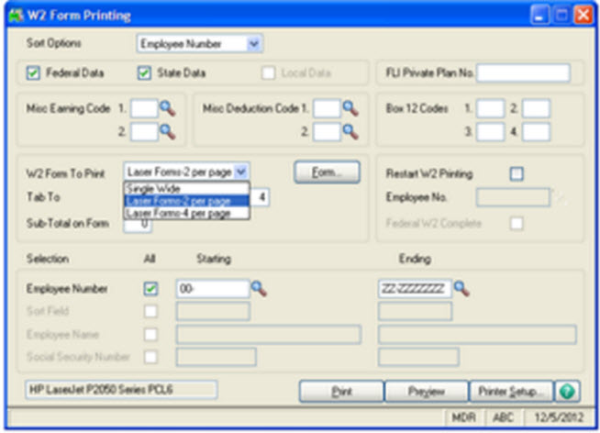

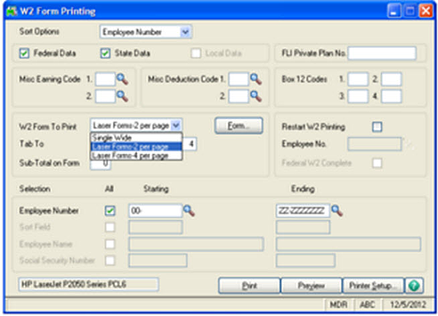

First step: Go to Payroll > Period End Processing > W2 Form Printing. These forms are designed to print on the preprinted forms available from the IRS or any office supply store.

a) Federal and State Data boxes, only click the State Data box if you need to report to a State.

b) Select the correct form to print onto: Single wide, Laser form -2, Laser form-4.

c) Normally if we do the IRD, it is a good idea to reset the form, click the Form button and then the Reset Button.

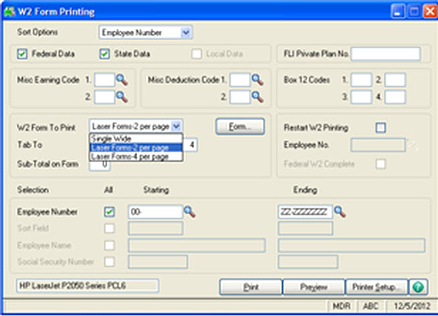

Second step: Test print the form:

a) It is a good idea to test the printing to plain paper first, select a couple employees from the employee Number Sort and just print to paper.

b) Do not preview the form as this can cause problems.

c) Check the plain paper print outs against the W2 forms.

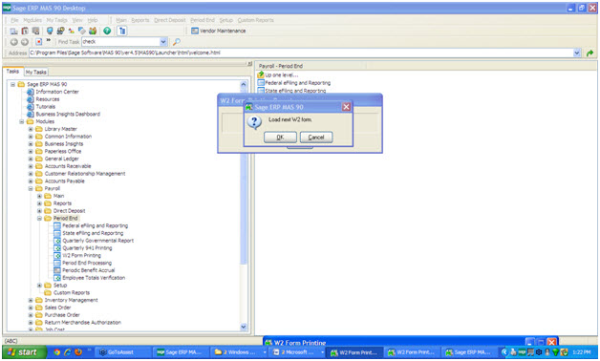

Third step: Load the forms and print each form A, B, C and D. Set the Number of Forms to 4, each time you print one set of forms, the system give a message Load next W2 form.

Written by Mike Renner, Partner WAC Consulting, Owner at Computer Accounting Services

Mike is and expert on Sage 100 ERP with over 25 years in the accounting software industry. Mike is also a Sage Certified Trainer and a recognized leader in the design, implementation and support of ERP systems, including Sage.

Sage 100 ERP (formally Sage MAS90/200), Sage 100 Fund Accounting (formally MIP Non Profit Software), Sage Grant Management, Sage Online Fundraising, QuickBooks Enterprise and Point of Sale VAR.

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process Payroll. How do we get and install the W2, 1099 End of Year IRD updates?

Sage 100 Tips and Tricks - Custom Financial Reporting Question: Mike, we own Sage 100 ERP (formerly Sage MAS90),

Question: Mike, we own Sage 100 ERP (formerly Sage MAS90), we process payroll. How do we get and install the new tax table updates?