Fiscal Year End, Are you Ready?

It’s getting to be that time of year, that’s right, fiscal year end. Don’t worry; this blog will not refer to any fiscal cliffs, political debacles,...

How many of you are paying Sage software maintenance and taking  advantage of what’s provided via the Sage customer portal? You’re maintenance covers access to the Sage 100 ERP customer site which can provide some great information regarding year end checklists, payroll updates, and end of year updates.

advantage of what’s provided via the Sage customer portal? You’re maintenance covers access to the Sage 100 ERP customer site which can provide some great information regarding year end checklists, payroll updates, and end of year updates.

Contact your Value Added Reseller, ASI, to access your Sage customer site if you haven’t already done so.

Year End Checklists

There is a checklist for every module as well as some handy facts that can guide you in keeping your processes clean and consistent. Here is a good place to start though:

Sage 100 ERP Closing Process – Close your modules in this order….

System Wide Backup – always back up your data!!

There is a method to this madness, in other words, a logical reason to follow this order for closing. One thing to keep in mind is that transactions from Sales Order can be posted to the Inventory and Accounts Receivable module, a good reason to complete any processes before closing that module. Backing up your data is one of the most important practices to drill into your head! Year End processes cannot be reversed, the only thing that can be done is to restore a backup of the data. So if you are taking backups, then you are all set. Don’t be that person/company that forgot to take a backup!

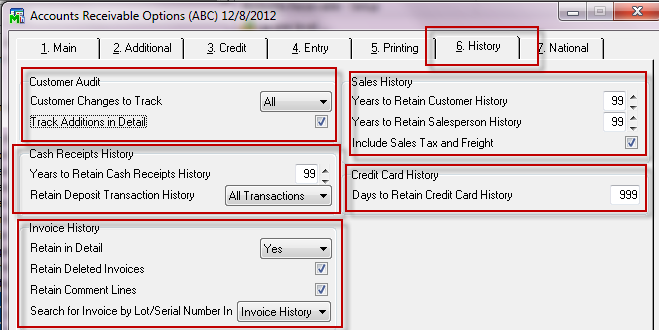

Before running your closing processes, this is also a good time to check your module options. Do you know how much history you are retaining? Better yet, are aware of how much history you need to retain? These days with new servers, there really isn’t a good excuse not to retain history. It used to be that server space was precious and servers generally didn’t have the processing capabilities they do now. In order to keep systems running smoothly and prevent servers from bogging down, consultants would only setup ERP systems retain the absolute minimum amount of data to retain for tax and audit purposes. However, for historical data and reporting, taxes, and audits, it’s always best to play to the conservative side and make sure you have all the data you need. What this means to you is that you probably should double check your settings. Each module has different options. For example, in the Accounts Receivable module you will notice the following:

You have the ability to retain Cash Receipts, Invoice, Sales, and Credit Card (PCI compliant, of course) history. ASI recommends entering “99” – “999” for years or days to retain, this essentially allows the system to keep all history. In addition, ASI always recommends turning on Audit tracking. This allows you to run the audit report to see who made changes and when those changes were made. This can be especially nice for those companies looking to become compliant with Sarbanes Oxley or looking to beef up their internal control processes.

Payroll and Year End updates to come in the year end blog, part III!

Jenn brings to ASI a unique background in accounting and business. With not only technical and functional experience but project management skills as well, Jenn has fundamental knowledge of all the phases of an implementation project. She has worked as an end user as well as a consultant, giving her the perspective to understand system “pain points” and know how to analyze and present solutions. Her project expertise includes: Software Implementations and upgrades, Distribution / Inventory, Client Server Applications, Business Process Reviews and Optimization, as well as System Analysis and Design. She also has experience in logistical project planning as well as technical experience with Crystal Reports and SQL. Part of Jenn’s upgrade experience also includes upgrading Sage 100 Providex clients to Sage 100 SQL. To contact Jenn or find out more about what her team at ASI can do for your business visit ASISucceed

It’s getting to be that time of year, that’s right, fiscal year end. Don’t worry; this blog will not refer to any fiscal cliffs, political debacles,...

Sage 100 ERP FRx Reporting No Longer Supported FRx is not Windows 7 or Windows 8 compliant, even if they are the 32 Bit versions. FRx must be run on...

Sage 100 ERP Phoenix, AZ Sage Software has strongly marketed their top reasons to upgrade to Sage 100 ERP Version 2013 and compatible Sage CRM...