3 min read

W-2 Filing Checklist – Helpful Tips for Preparing 2012 W-2’s (Part 2)

There are many sources of information for employers about filing W-2’s. However, it’s not always easy finding a W-2 filing checklist or summary of...

2 min read

Denise Phillips Thu, Jan 03, 2013

The holidays, year-end and tax filing deadlines can make this a stressful time of year. We hope you find the information helpful while preparing your W-2 filings. The 4 tips compiled below hopefully helps take some stress out of the W-2 filing process for you. Getting it done right the first time is far better than the hassle of having to resubmit forms due to errors. Stay tuned for more tips in Part 2 of this W-2 filing checklist series.

Happy New Year!

Please inquire with us if you’d like to learn more about W-2 filing or how our Sage 100 ERP consultants can help your business uncover hidden revenue and cost-savings.

About Sage 100 ERP Consultant - Convergence Technologies, Ltd. - The mission of Convergence Technologies, ltd. is to provide quality business technology with exceptional service for our customers while promoting an enjoyable environment of continuous learning and growth for our staff. Convergence Technologies, Ltd. Is based in Fort Wayne, IN and proudly serves the area and the nation helping customers grow their business. Contact us at 877-483-0717 or visit http://www.converg-tech.com/contact-us.html to learn more how our Sage 100 ERP Consultants can help your business grow!

3 min read

There are many sources of information for employers about filing W-2’s. However, it’s not always easy finding a W-2 filing checklist or summary of...

What are accounting procedures and why should I consider developing them for my business?

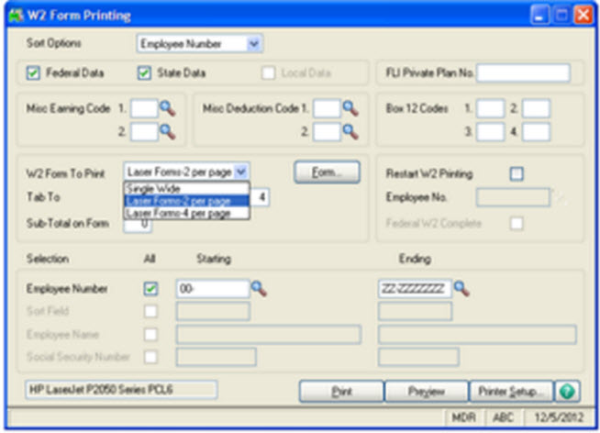

Question: Mike, we own Sage 100 ERP (formally Sage MAS90), we process Payroll. How do we run the year end W2 forms.