Why Cloud Accounting Software?

Considering How "Cloud Accounting" Fits For Your Business According to Gartner Research, spending on “cloud” or browser-based applications will...

3 min read

Seth Pomeroy Wed, May 29, 2013

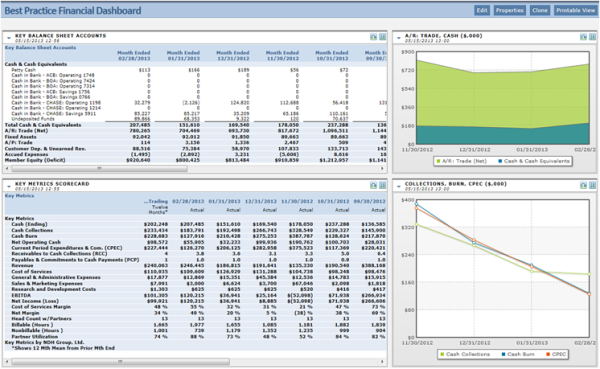

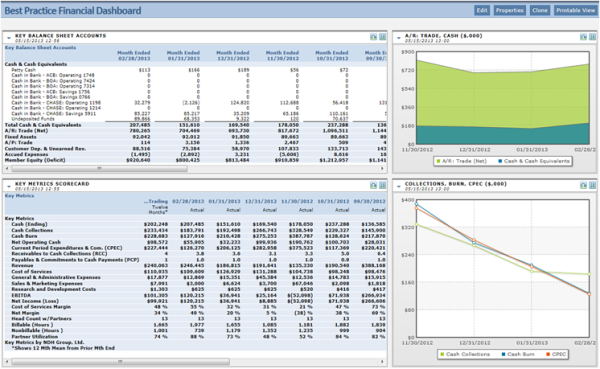

Maintaining the attention of company stakeholders is key to the success of business intelligence tools like financial dashboards. In our experience, business owners will quickly drop interest in logging into yet another system unless the operating environment supporting their dashboard view is stable, self-automating, and serves-up relevant data. To help retain attention, today we’re outlining best practices for managing the operating environment, with subsequent topics specific to the focus and formatting of the dashboard. Getting actionable information from financial dashboards can be realized with some forward planning, and will enhance high-level support of the company’s Enterprise Resource Planning (ERP) efforts.

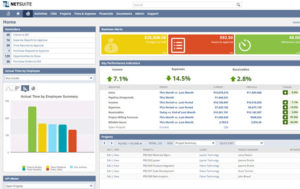

While some of our recommendations can be applied to different systems –limitations apply. For getting around these, underlying features matter, and so we recommend Intacct. True web-access, custom reporting and metrics, real-time consolidation of multi-entity and currency, automation of complex billing rules, and a wide-array of data dimensions, to name a few, give Intacct users the power to ultimately script good dashboards. Having established this, let’s move on to some specific suggestions for configuring the system to ensure the key audience is hooked.

We’ve reviewed the importance of attracting stakeholder interest in dashboards and outlined strategies for system use and configuration to retain interest. By managing a single, easy to access, live, and comprehensive reporting tool, and acknowledging some tradeoffs, we think Exec.’s get a better view of the trends and risks of their business. Next edition we’ll cover strategies for focus, including the selection of dashboard components for maximum impact and decision support.

Contact us if you need help with financial dashboard reporting or any additional finance, accounting, tax, or accounting technology services. Visit us at www.ndhcpa.com.

Considering How "Cloud Accounting" Fits For Your Business According to Gartner Research, spending on “cloud” or browser-based applications will...

Real-Time Dashboards with an Integrated Cloud ERP Solution In every growing business, it’s important to have access to real-time, relevant and...

Accounting software is an extremely important tool for every business. For many small companies or start-ups QuickBooks is a great system. As time...