Join Avalara for 12 Sales Tax Survival Tips: Webcast Tuesday, March 26

Sales tax has never been more complicated with thousands of rate, rule, and boundary changes every year. Unfortunately, this trend will only...

2 min read

Kathy Graham Wed, May 29, 2013

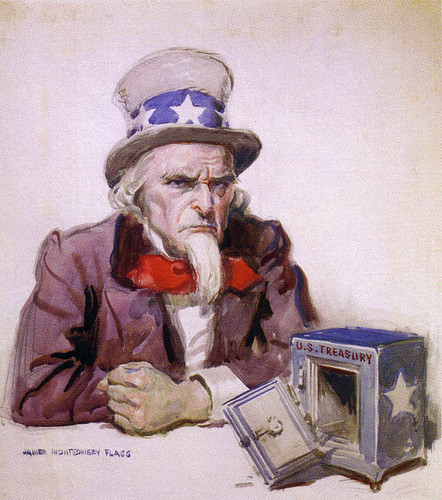

Our U.S. government is strapped for cash and they are looking for ways small and medium sized businesses (SMBs) can help pay for this deficit. ERP software with sales tax automation will be more important for SMBs as our states look for new sources of revenue. There are two ways states look to sales tax as the answer to their deficit problems: 1) Collecting sales tax brings in money for the states with every sale of taxable items. 2) If businesses do not calculate or collect sales tax correctly for their sales, they owe the states penalties in the face of an audit. Did you know that states are hiring an extra team of sales tax auditors to catch and collect penalties from businesses who don't calculate, collect and report on sales tax accurately? Sales tax complexity is the answer to to help compensate for states budget crisis. How can small businesses get prepared to avoid penalties in the face of an eventual audit? Sales tax is so complex that businesses who have not automated sales tax complaince will become a source of revenue for the states. Our states have thousands of rate, rule, and boundary changes every year in the US and an epic legal debate over e-commerce taxation, managing sales tax has never been more of a hassle. Unfortunately, this trend will only continue to get worse as states hire more auditors to find businesses that aren’t paying attention to the nuts and bolts.

Our U.S. government is strapped for cash and they are looking for ways small and medium sized businesses (SMBs) can help pay for this deficit. ERP software with sales tax automation will be more important for SMBs as our states look for new sources of revenue. There are two ways states look to sales tax as the answer to their deficit problems: 1) Collecting sales tax brings in money for the states with every sale of taxable items. 2) If businesses do not calculate or collect sales tax correctly for their sales, they owe the states penalties in the face of an audit. Did you know that states are hiring an extra team of sales tax auditors to catch and collect penalties from businesses who don't calculate, collect and report on sales tax accurately? Sales tax complexity is the answer to to help compensate for states budget crisis. How can small businesses get prepared to avoid penalties in the face of an eventual audit? Sales tax is so complex that businesses who have not automated sales tax complaince will become a source of revenue for the states. Our states have thousands of rate, rule, and boundary changes every year in the US and an epic legal debate over e-commerce taxation, managing sales tax has never been more of a hassle. Unfortunately, this trend will only continue to get worse as states hire more auditors to find businesses that aren’t paying attention to the nuts and bolts.

Sales tax is hard; and manually keeping up with changes takes up a lot of valuable time and effort that could be better spent growing your business. All that time wasted looking up changing rates and rules or digging through the filing cabinet to see if a resale certificate is up to date! You already outsource payroll. The time is now to do the same by automating and streamlining your sales tax within your ERP system.

Join us for a free informational webinar on May 30, 2013 to learn about 2013 changes in sales and use tax and see how the latest technology for Sage can help simplify your sales tax process. In this webinar, the tax experts at Avalara will introduce 5 sales and use tax tips that will help your business develop an effective, proactive, sales tax strategy long before the auditor knocks on your door.

Title: 5 Sales and Use Tax Tips for 2013 and Beyond

Date: May 30, 2013

Time: 10:00 AM - 11:00 AM PT

Sales tax has never been more complicated with thousands of rate, rule, and boundary changes every year. Unfortunately, this trend will only...

The Marketplace Fairness Act of 2013 (S.743) is a bill awaiting a vote in Congress that will require large online retailers to charge customers...

As ERP consultants and ERP customers, you may have noticed there are thousands of sales tax rate, rule, and boundary changes every year. Join us in...