If You’re Using ERP for Accounts Receivable Management You Need to Read This

ERP systems are impressive and powerful tools and the backbone of companies around the world. As ERP resellers and developers, we know this to be...

1 min read

Community User Wed, Jul 10, 2013

If your business offers credit terms you probably have a problem collecting accounts receivable and you may have no idea what kind of negative impact that is having on your bottom line and your cash flow. How bad is it?

Most companies sell on 30 day terms, but an analysis of average days-to-pay or days sales outstanding will probably reveal to you a serious problem; most of your customers are taking much longer than that to pay their bills. Many companies report that customers are taking 45-60 days to pay. Why is that a problem?

ERP publishers have some great accounting and ERP products but none of them make collecting accounts receivable easy for your accounts receivable personnel to improve collections. Many companies use memos to track communications with customers regarding late payments and others rely solely on printed aging reports and highlighters to manage the collections process. Typically you don’t even focus your time and energy on collecting until you have a cash flow problem or you have accounts that are grossly past due with huge balances. Sound familiar?

Imagine if you could send dozens of past due notices to your customers with just a few mouse clicks; have all of their invoice history, account aging, and contact information available at your fingertips; and be able to focus your limited time on those accounts and invoices that need your attention the most. That would be huge!

If you sell on credit terms you really need to take a hard look at your current average Days-to-pay or Days sales outstanding- right now you may be thinking, “Yeah my customers take a few extra days, but it’s no big deal as long as they pay.”

____________________________________________________________________________________

ERP systems are impressive and powerful tools and the backbone of companies around the world. As ERP resellers and developers, we know this to be...

As the publishers of Anytime Collect accounts receivable management software, we’ve written countless articles explaining the need for and the...

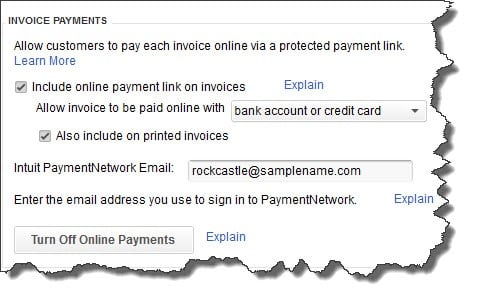

As QuickBooks consultants, we work with small business owners who want to use technology to make their business more efficient and competitive. One...