Multicurrency Credit Card Processing with SAP Business One

Credit Card Processing for SAP Business One – Multicurrency on a Single Database One reason SAP Business One (SAP B1) is the popular choice among...

Credit Card Processing: October 1st is the EMV Deadline

Credit Card Processing: October 1st is the EMV DeadlineAlthough Halloween does not come till the end of October, EMV is coming October 1st. The question is simple. How many people have tried to scare you to death about EMV? Now before you get scared let’s remember that little thing called Y2K when they said the computing world would end. Did it end? No. Will the world end with EMV? No. However, you have a few challenges to avoid to keep you from getting scared to death and maybe even scare your clients away.

EMV is a global payment standard, which provides the consumer/cardholder a consistent experience around the world. Typically, America is the leader, but this time we are the last to fully implement this next evolution in credit card processing security. The nice part about EMV is when this was fully implemented in other countries over the past several years, they saw a reduction in counterfeit/stolen retail credit card transactions. The goal of EMV technology is to save money by reducing the chance for fraudulent activity.

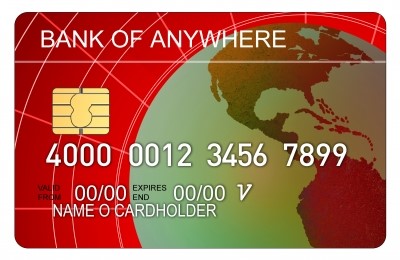

EMV enabled cards are the ones with that funny looking chip on the front of the card. That funny looking chip is the technology used to stay one step ahead of the bad guys. Just think of the several changes that have happened to the United States currency in the last several years to prevent fraud and counterfeiting. This is just a part of life, so do not be scared because as a client of American Payment Solutions we have you covered.

In the long run this is a good thing for all. In the short run this is not as much fun because the deadline is here and not everyone is ready.

A slight liability shift. If your customer/cardholder is using an EMV enabled card or should I say a criminal counterfeits or uses a stolen card, you will be held liable for chargebacks if you are not utilizing the proper hardware/software. The reality on this matter is fairly simple. The liability will fall back to the party that is using the least secure technology. If you see the funny looking chip use a terminal that is EMV enabled. Please remember we are only talking about card present transactions.

Do not be scared of this transition. Keeping this transition simple for your employees and yourself is the best way for you to shift the liability back to the issuer and away from you.

Never forget you have us here to help you with another bump in the road of running your business.

Image courtesy of freedigitalimages.net by Prawny

Credit Card Processing for SAP Business One – Multicurrency on a Single Database One reason SAP Business One (SAP B1) is the popular choice among...

Acumatica users now have an easier way to process credit cards that could save your company money. Using Acumatica credit card processing from...

Credit Card Processing Fees - Be Aware of Flat Rates and Fees! Due to complicated credit card processing fees structures, some merchants may hire a...