Financial Planning Software: Gartner Group Reviews Adaptive Insights

Financial Planning Software: The Gartner Group Reviews Adaptive Insights Are you evaluating Financial Planning software options? If so, The Gartner...

3 min read

John@oasisky.com Mon, Mar 12, 2018

Financial Planning and Analysis (FP&A) - Top Challenges and Solutions

Financial Planning and Analysis (FP&A) - Top Challenges and SolutionsSmall and mid-sized businesses often rely on Excel to create Financial Planning and Analysis (FP&A) which is a tedious and cumbersome tool. If you rely on reporting it’s usually the task of a Controller or someone in accounting to provide the owners, CFO, or the CEO with the right kind of data to make strategic decisions. This person usually spends an enormous amount of time and effort collecting and creating reports that include budgeting, forecasting

The challenge with generating FP&A reports manually is the accounting system’s reporting is not integrated to all the data needed from the various departments. You now rely on each manager to pull the right data from these disparate systems. The old adage that “timing is everything” applies to FP&A reporting because any delays in the right information at the right time interrupt your ability to generate timely accurate reports to make decisions with reliable data. Timely data assembled in a way that’s accurate and efficient is essential to make decisions when needed and not when it’s too late for after-the-fact reporting.

If you are working with manual reporting tools like Excel and non-integrated systems, the benefits of creating Financial Planning and Analysis (FP&A) reporting is diminished. Here are some signs your Financial Planning and Analysis (FP&A) needs an overhaul.

If you experience any of these challenges with your FP&A reporting, we have a solution for how you can fix it!

Ready to fix your failing FP&A process and not sure where to start? Let Oasis help.

Since 1991, Oasis Solutions has been serving businesses throughout North America with software consulting, development, training, and support. Oasis is an award-winning business management software partner for Sage software, NetSuite, and Adaptive Insights.

Oasis has been around since before technology was a buzzword, assisting businesses in assessing, attaining and supporting business management software.

With more than 250 years of combined industry experience, our team of software specialists offers expertise in accounting, human resource management, salesforce automation and custom software development.

Oasis Solutions has offices in Louisville and Lexington, KY, and Nashville, TN.

It’s Not Just What We Bring To The Table, It’s Who.

This blog was repurposed and originally written by John Stanovich, MBA on February 23, 2018 - 3 Reasons Why Your FP&A Is Failing And How To Fix It

Photo courtesy of freedigitalpphotos.net by

Financial Planning Software: The Gartner Group Reviews Adaptive Insights Are you evaluating Financial Planning software options? If so, The Gartner...

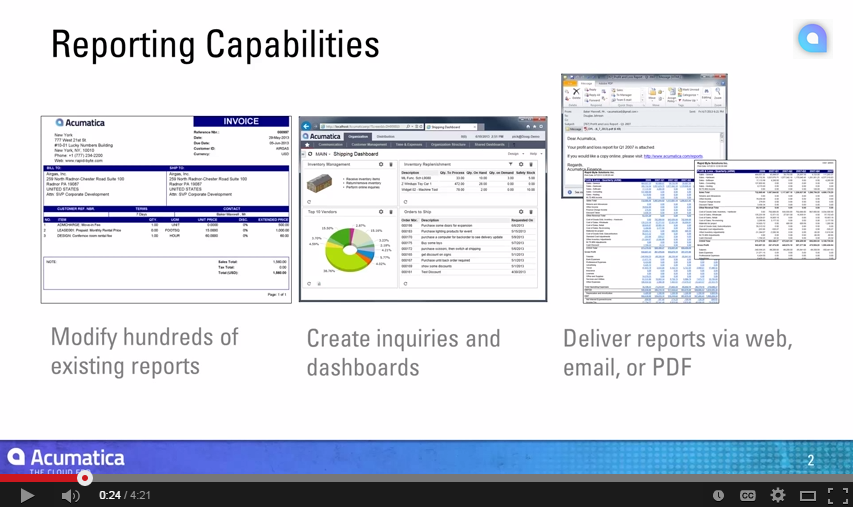

Acumatica and Microsoft Dynamics New York Reporting Tools: Reviews Business Intelligence As accounting and business management software consultants...

As ERP consultants, we have seen tremendous progress over the last few years in how our customers get information about their business with the...