1 min read

Microsoft Dynamics NAV 2016 Wins Big with Mobile ERP App

Microsoft Dynamics NAV 2016 New Mobile App Since the release of Microsoft Dynamics NAV 2016 our small to mid-sized customers have been raving about...

4 min read

Greg Miles Mon, Nov 16, 2015

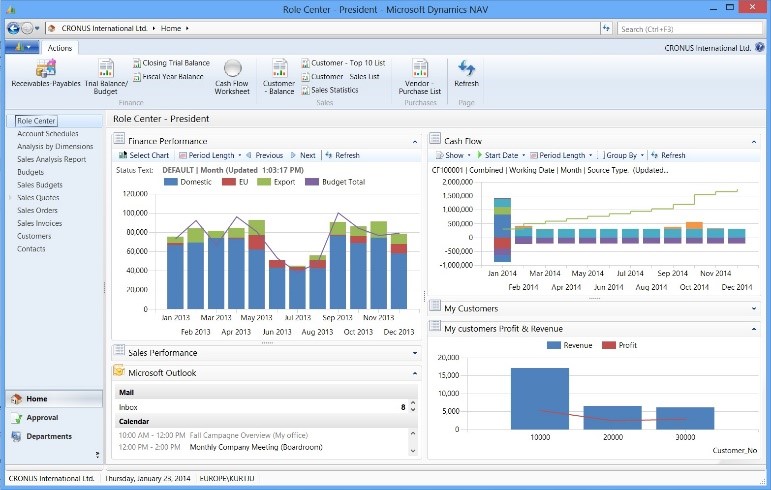

Microsoft Dynamics NAV 2016: 8 Financial Management Enhancements

Microsoft Dynamics NAV 2016: 8 Financial Management EnhancementsThe new Microsoft Dynamics NAV 2016 has just been released. It has new ERP functionality in mobility, business insights and cloud services. Microsoft has a long proven track record of creating products which continue their standards of excellence in their well thought out product “Roadmap”. NAV 2016 is fully equipped with a robust profile to support small to mid-sized businesses. The newest version of NAV is fully equipped to support your company’s financial processes by providing better control and visibility in these ways:

1. Cash Flow Forecast: Forecast estimates the breadth of a company’s liquidity—cash and other treasure positions—and the span of growth and evolution over time. This feature is two-fold, and is comprised of cash receipts (the money you expect to receive) and cash disbursements (the cash you expect to pay out) also accounting for the liquid funds you have available. Microsoft NAV 2016 utilizes an understanding of these elements to formulate predictions to make a direct Cash Flow Forecast.

2. Multiple Currencies: NAV is able to calculate and manage multiple currencies simultaneously, including payables and receivables, and assimilates values from general ledger reports, resource and inventory items and integrates bank accounts using Cash Management features. Microsoft Dynamics NAV 2016 Multiple Currencies makes it possible to:

3. Bank Account Management: Cater to your diverse business needs across different currencies easily by using this feature to create, operate, and manage multiple bank accounts.

4. Electronic Payments and Direct Debits: Use vendor documents to create payment proposals and generate bank payment files in ISO20022/SEPA format or take advantage of the Bank Data Conversion Service to generate the appropriate electronic payment file for your bank. Easily keep track of the payment export history for your electronic payments and recreate a payment file whenever needed. Apply payments is a feature which comes with simple streamlined process to mark and process the desired transactions. Create direct debit collections to get the money directly from your customer’s bank account and generate a bank direct debit file in ISO20022/SEPA format.

5. Reconciliation of Incoming and Outgoing Bank Transactions: Import bank transaction data from electronic files sent from your bank in ISO20022/SEPA format—or use the Bank Data Conversion Service for other file types. Apply the bank transactions automatically to open customer and vendor ledger entries and create your own mapping rules. Review the proposed applications and account mappings in an easy and intuitive way. It is possible to modify the algorithm behind the record matching by modifying, removing or adding rules.

6. Check Writing: Generate Computer printed checks with a unique number series for each bank account. You can specify on the payment journal line whether you want this payment to be made with a computer or a manual check. This feature helps your internal control in that it can ensure the computer check is printed prior to a check being posted. This eliminates time being wasted in the interim. Check printing comes with flexible user options, such as voiding a check, reprinting, using check forms with preprinted stubs, testing before printing, and also the possibility to consolidate payments for a vendor into a single check.

7. Bank Account Reconciliation: Import bank statement data from electronic files sent from your bank in ISO20022/SEPA format—or use the Bank Data Conversion Service for other file types. Reconcile your bank statement data automatically to open bank account ledger entries and keep track of all bank statements.

8. Cost Accounting: Cost Accounting provides an efficient way to control the company’s costs by providing visibility and insight into budgeted and actual costs of operations, departments, products, and projects. Cost Accounting synchronizes cost information with the general ledger, and then allocates that information to different costs centers and cost objects.

This module in NAV enables your company to:

Learn more about all of the features in Microsoft Dynamics NAV here

Contact us today with any questions about Microsoft Dynamics NAV 2016

Posted by iCepts Technology Group, Inc. a Pennsylvania Gold ERP Microsoft Dynamics NAV Partner

About iCepts Technology Group, Inc. Middletown, PA

We are a Microsoft Dynamics NAV Partner offering implementation, service, and support for Microsoft Dynamics NAV in: PA, DC, DE, MD, NC, NJ, NY, OH, VA, WV, and the entire Mid-Atlantic Region. We also offer implementation, service, and support for Accellos One Warehouse Management Systems in: PA, DC, DE, MD, NC, NJ, NY, OH, VA, WV, and the entire Mid-Atlantic Region.

As experienced SCM, WMS and ERP consultants and value added resellers (VARs), we provide start to finish services for the solutions we represent Microsoft Dynamics NAV for Distribution and Manufacturing, Accellos Warehouse Management System (WMS), Server virtualization, open source VOIP phone systems and infrastructure and security. We provide services that cover process analysis, implementation, training, security and networking. Naturally, we also provide full ongoing support for years after implementation to help our clients succeed. We are your one stop shop for your business technology needs.

Phone 717.704.1000

Email info@icepts.com

Another version of this article was posted on iCepts Blog October 28, 2015 by Greg Miles: Financial Management ERP Features in Microsoft Dynamics NAV 2016

By Greg Miles - iCepts

1 min read

Microsoft Dynamics NAV 2016 New Mobile App Since the release of Microsoft Dynamics NAV 2016 our small to mid-sized customers have been raving about...

Microsoft Dynamics NAV 2016 Consultant Reviews How Workflow and Document Templates Help Increase Productivity There have been so many new features in...

Microsoft Dynamics NAV 2016: A Deeper Look at Business Intelligence Access and insight into critical decision making information is key to...