1 min read

ERP Software Simplifies Sales and Use Tax: 5 Tips for 2013 & Beyond

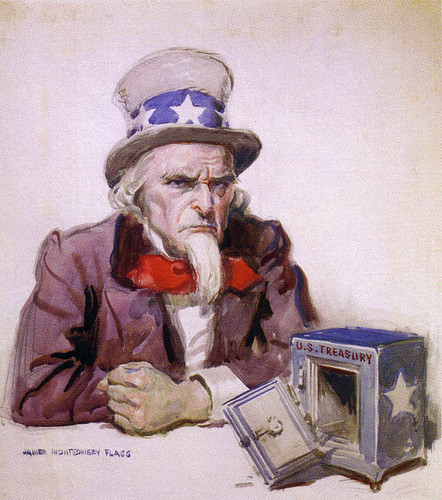

Our U.S. government is strapped for cash and they are looking for ways small and medium sized businesses (SMBs) can help pay for this deficit. ERP...

Get the skinny on all the sales tax changes changes before they happen

The weather is heating up and everyone is getting ready for summer, but before you unload the beach chairs, we have some potentially unpleasant news. July 1st marks the fiscal new year for 46 states and that is the time when many of them roll out new sales tax rates and taxability rules. What this means for you is that you’ll need to stay on top of those changes to be sure you remain compliant.

"More than ever, sales tax compliance is exceptionally challenging"

There are still many states trying to find ways to increase revenue to make up for shortfalls resulting from increased online sales. As a result, sales tax is being broadened, rates are increasing, and exemptions are being temporarily suspended. More than ever, sales tax compliance is exceptionally challenging, particularly for businesses selling in multiple states.

Legislators in each state are working on their own creative ways to make up for the budget deficit. Some are increasing rates on taxable items sold within the state while others are expanding the definition of nexus to try and collect tax revenue on more out of state transactions. Everyone is talking about South Dakota’s new economic nexus legislation, which could require you to collect and remit sales tax there even if you don’t have any sort of physical presence in the state.

With every new round of changes, businesses are struggling to stay on top of everything that could affect their processes and put them at risk of non-compliance. All the while, auditors are ready to catch those errors to collect hefty penalties to help make up some of the deficit.

But fear not, because we are here to help! Our sales tax compliance automation partner, Avalara has done all of the research and prepared a presentation to fill you in on all of the changes that will be in effect in the coming weeks. The presentation will cover:

To get prepared and make sure you’re all set before the changes happen, sign up for the webinar now! Then you can go relax by the pool with a margarita to reward yourself for being so proactive.

1 min read

Our U.S. government is strapped for cash and they are looking for ways small and medium sized businesses (SMBs) can help pay for this deficit. ERP...

As ERP consultants and ERP customers, you may have noticed there are thousands of sales tax rate, rule, and boundary changes every year. Join us in...

Sales tax has never been more complicated with thousands of rate, rule, and boundary changes every year. Unfortunately, this trend will only...