6 Benefits of Dynamics GP Purchase Order Processing

Dynamics GP Purchase Order Processing (POP) Benefits and Video Demo Microsoft Dynamics GP has powerful Purchase Order Processing (POP) capabilities...

2 min read

John Peace Mar 19, 2014 9:59:00 AM

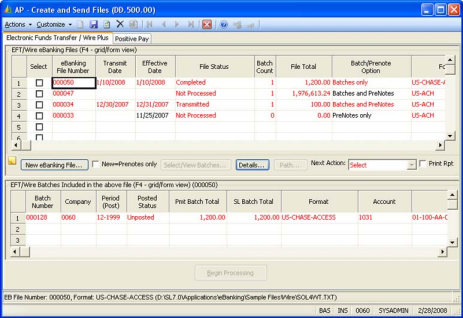

Our Microsoft Dynamics SL clients are thrilled to learn that electronic banking services is now available with the eBanking Suite. The modules available in the eBanking Suite for Microsoft Dynamics SL can not only help you reduce your costs with automation, but they also provide secure banking and fraud protection. Learn more how these 5 modules can help you avoid check fraud with A/P and Payroll checks, handle multi-company transactions and handle multiple formats along with the ability to create custom formats. Here are some questions we get from our clients. The answer to all these questions with Microsoft Dynamics SL the Banking Suite is YES, YES, and YES!

The eBanking Suite for Microsoft Dynamics SL is comprised of the following five modules:

Accountnet is a Microsoft Dynamics Gold Certified Partner and can help you determine whether the eBanking Suite for Microsoft Dynamics SL is right for your organization. Contact us or give us a call (212) 244-9009 for a free phone consultation.

Another version of this article was originally posted on AccountNet’s Blog on March 13, 2014: http://www.accountnet.com/ebanking-suite-microsoft-dynamics-sl/

Dynamics GP Purchase Order Processing (POP) Benefits and Video Demo Microsoft Dynamics GP has powerful Purchase Order Processing (POP) capabilities...

What are the Benefits of Using Dynamics GP Fixed Assets Management Module? As Microsoft Dynamics GP consultants, we get questions from our clients on...

Warehouse for AX (WAX) is a Certified for Microsoft Dynamics 2012 (CfMD) module that embeds advanced supply chain capabilities into Dynamics AX to...