Cut Costs With Level 3 Payment Processing

Look into Level 3 Integrated Payments Processing When You Need to Cut Costs Are you experiencing the pressure to reduce costs as a finance and...

How Much Can You Save on Your Monthly Rates with Sage 100 Credit Card Processing?

You've undoubtedly heard a lot about Sage 100 credit card processing and how it enables easy processing of Level 3 payments that require enhanced data. You may not realize precisely how much you can save on your interchange rates. Find out exactly how much you can expect to save when you integrate payments with your Sage 100 financial management system.

In case you missed it in this previous post about Sage 100 credit card processing here’s a short summary of what it means to process Level 3 payments.

The term Level 3 refers to the ‘line-item details’ you must transmit when a payment card is presented for purchase. Transaction details will include purchased items, quantities, and other merchant-specific order information. This information is made available when the purchaser uses any card issued for a specific type of business purchase by a business or government agency such as government-issued cards, business or corporate purchasing cards.

Generally, government agencies and some businesses that also use purchasing cards will mandate Level 3 data to monitor their employees’ spending. A fast-growing segment of payment types, you’ll want to be prepared when those types of cards are presented or risk expensive downgrades.

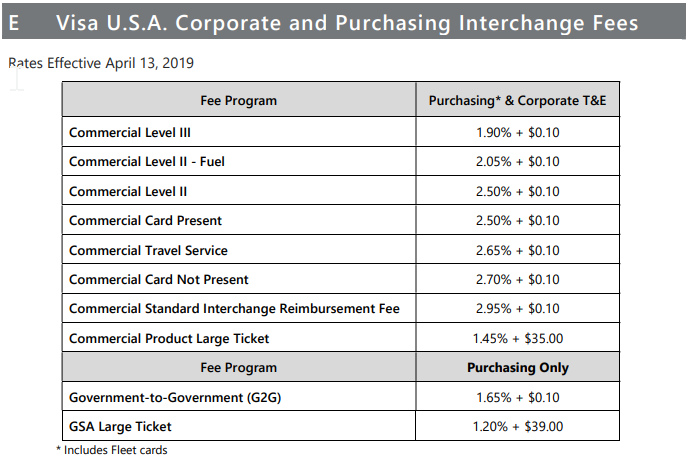

For the business taking the card, processing transactions by including level 3 data will result in lower costs than level 1 data, resulting in a lower overall cost. Visa’s interchange rate reimbursement table specifically displays that B2B payments are charged better pricing.

Now let’s take a close look at Visa’s rates and calculate exactly how much you can save with Level 3 processing:

For example, a transaction that qualifies for Commercial Level 3 would be charged 1.90% + $0.10 which is .60% cheaper than the rate for a Commercial Level 2 transaction which is shown as 2.50% + $0.10.

In scenarios where you accept a commercial credit card and don’t provide level 3 data, you’ll pay .80% more because the Commercial Card Not Present category will cost you 2.70% + $0.10 compared to Level 3.

The single most expensive fee category, and one you’ll want to avoid, is the Commercial Standard Interchange Reimbursement Fee category. If you accept a commercial credit card, don’t provide level 2 or 3 data, and also fail to pass minimum requirements, you can expect to pay a whopping 1.05% more than you could have paid with Level 3.

Paya is the leader in delivering simpler, more efficient, and deeply integrated payment solutions with more than 25 years of industry experience and 2,000+ industry customers and partners. Paya is committed to delivering best-in-class integrated payment solutions across the full suite of Sage ERP products. We are proud to be Sage’s preferred partner for Integrated Payments in the US.

At Paya we are unique from our competitors because we emphasize solutions engineering, engaging our domain experts as part of the early sales process. Through a collaborative but simple hands-on process, we develop a deep understanding of our partners’ current processes and pain points and requirements to ensure you get a platform and system with the capabilities you need. Paya has enabled businesses to optimize billing and invoice processes, deliver more payment options and flexibility to their customers, and improve back-office efficiencies.

Contact Paya's Acumatica Integrated Payments team to schedule a free consultation today!

Learn more about how our credit card processing experts, solutions, and processes can benefit your organization and save you money!!

See Paya's Acumatica Integrated Payments solution on ERPVAR's site.

Look into Level 3 Integrated Payments Processing When You Need to Cut Costs Are you experiencing the pressure to reduce costs as a finance and...

What Sage 100 Payments Solution Works Best for Your Business? If you are looking for a Sage 100 credit card processing solution, the good news is you...

2 min read

Go Beyond 1980s Technology with Sage 100 Integrated Payments While memories of the 1980s may evoke feelings of nostalgia and fun, it's important not...