4 reasons to choose Nuvei for Sage Intacct payment and AR automation

Top benefits of Sage Intacct payment and AR automation by Nuvei The benefits listed below highlight key differentiators that set this payment...

If you're a merchant, you've probably gotten many offers from credit card processing companies to switch from using Sage Intacct payments. These companies might promise to lower your monthly bill, but these offers are often not worth your time. They are unlikely to give you better rates than you already have. However, there are other ways to save money and time. In addition to looking for lower rates, here are some other methods to decrease your monthly expenses.

When selecting a credit card processing company to work with Sage Intacct, it's essential to consider more than just rates. Many processors may try to win your business by undercutting the competition, but this may not necessarily lead to the best overall solution. At Paya, we understand that merchants are looking for ways to save money, but we also know there are other important considerations, such as automation and functionality. That's why we offer comprehensive services to automate payment-related processes, including AR automation. Beware of credit card companies that only focus on lowering fees with "discount rates" or lower transaction fees. We believe in providing high-quality services that meet all your needs as a merchant.

When selecting a payment provider, opting for one that can thoroughly analyze your transaction history to identify patterns that may result in lower rates is crucial. This procedure, known as interchange optimization, is not available from all payment providers. Suppose your business accepts P-cards from business or government entities. In that case, it's essential to provide Level 2 and Level 3 data to qualify for the best rates. Hence, it's vital to have a payment processing system capable of capturing and transmitting this data when receiving payments.

Advancements in credit card technology, including mobile payments and peer-to-peer electronic funds transfers, have made it easier for businesses to process transactions and receive payments. The integration and automation of credit card processing technology with Intacct has allowed companies to expand and thrive. By eliminating the need for manual card processing, businesses can save time and avoid mistakes.

Automating credit card processing tasks can help organizations save costs and increase productivity in other areas of the sales process. With an integrated Sage Intacct payments solution like Paya, duplicate data entries and errors can be eliminated, freeing up time for sales and finance teams. Our support and development team has the expertise and resources to ensure compliance, seamless integrations, and smooth payment processing.

If you're searching for an effective way to process credit cards, an automated and integrated solution may be the answer. This type of solution offers numerous features such as customizable reporting, secure storage of card information, an account updater, hosted payment pages, and mobile processing. Partnering with a Sage Intacct consultant who can understand your business needs and recommend a credit card solution that fits them is recommended. It's important to choose a credit card solution with a strong track record for implementation, support, and development. By collaborating with the right Sage Intacct payments and consulting team, you'll be able to tackle your challenges and add more value to your business in the long run.

Paya, a Nuvei Company, is committed to delivering best-in-class integrated payment solutions across the full suite of Sage ERP products. We are proud to be Sage’s preferred partner for Integrated Payments in the US. Paya has enabled thousands of businesses to optimize billing and invoice processes, deliver more payment options and flexibility to their customers, and improve back-office efficiencies.

Contact our Paya team to schedule a free consultation today! We're confident you'll learn how we are the right Sage Intacct payments provider for your business!

Another version of this blog was originally published on Paya's website - How to Reduce The Cost of Sage Intacct Integrated Payments

Top benefits of Sage Intacct payment and AR automation by Nuvei The benefits listed below highlight key differentiators that set this payment...

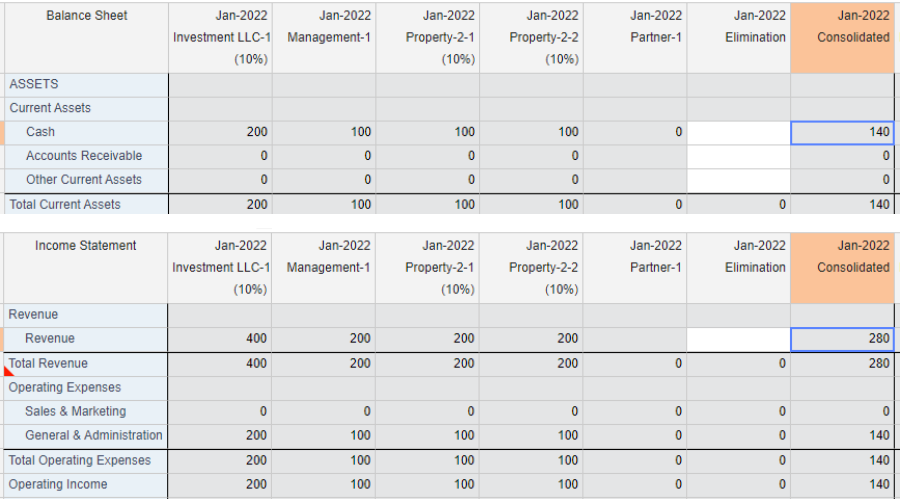

The ability to make sense of your operational and financial data to automate your SaaS KPIs is no longer optional. One of the most frequent issues...

Streamline Reporting for Multiple Entities with Partnership K1 Reporting If you're required to submit Schedule K-1 federal taxes, AppComputing's...